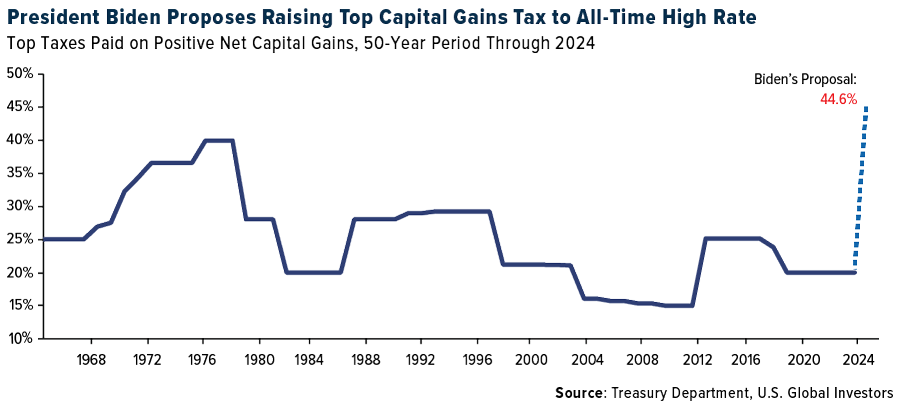

2024 Holiday Calendar Philippines Capital Gains Tax – Additionally, when selling a property, the capital gains tax may be 0% if an individual or couple’s taxable income is below the legal thresholds. Managing the Sale Date You could mitigate this tax . As the new capital-gains policy proposal laid out in the 2024 budget looms, claiming to target the wealthy few, we must ask ourselves if these changes will truly lead to what Ottawa promises: tax .

2024 Holiday Calendar Philippines Capital Gains Tax

Source : taxfoundation.orgSmall Caps Could Be Badly Hit by Biden’s Plan to Tax Unsold Assets

Source : www.investing.comProperty Tax in France 2024: Ultimate Guide for Non Residents

Source : www.ptireturns.com5,722 Capital Gains Tax Royalty Free Photos and Stock Images

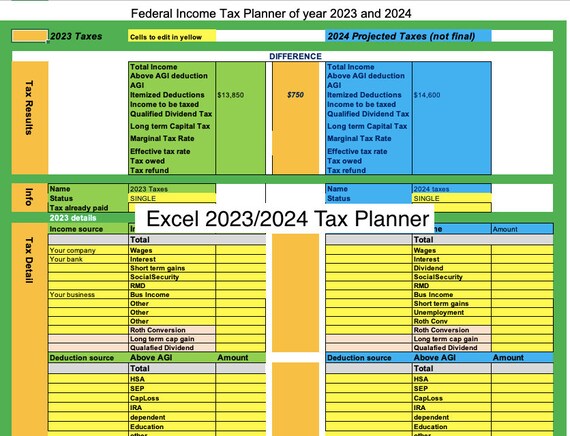

Source : www.shutterstock.comExcel 2023 and 2024 Tax Planner Spreadsheet, Self Employment etsy

Source : www.etsy.comTax Season Deadlines: What You Need To Know

Source : innovatureinc.comEasy Calculator for 2022 Qualified Dividends and Capital Gain Tax

Source : www.etsy.comWhat Is Tax Avoidance and How Is It Different From Tax Evasion?

Source : www.investopedia.com2019 2024 Form KY 765 Schedule K 1 Fill Online, Printable

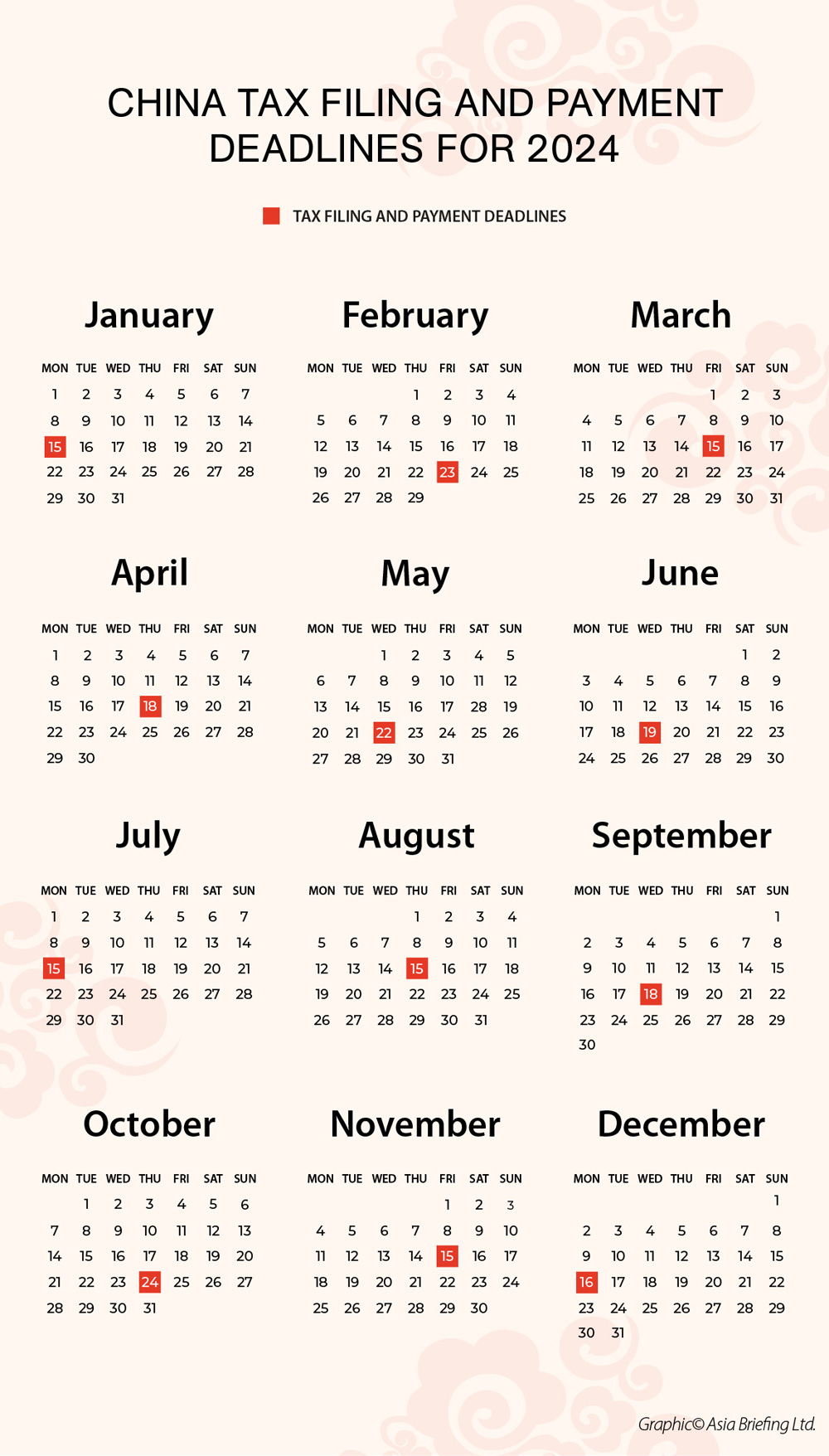

Source : form-765-schedule-k-1.pdffiller.comChina Tax Filing and Payment Deadlines for 2024

Source : www.china-briefing.com2024 Holiday Calendar Philippines Capital Gains Tax 2022 State Tax Reform & State Tax Relief | Rebate Checks: Selling a home is now so profitable that many more Americans are getting hit with an unexpected tax bill limit for couples to be exempt from capital-gains taxes, more than double the share . Tax treatment depends on your individual circumstances and may be subject to future change. Capital gains tax is the amount you pay on any profit you make when you come to sell an asset .

]]>

:max_bytes(150000):strip_icc()/tax_avoidance.asp-Final-9d7e3d82dc5c4ce293256ff9d548494d.png)